By JIM MILLER

(SAVVY SENIOR) A number of financial aid programs are available to help seniors with age-in-place upgrades. What’s available for these types of home modifications and improvement projects will depend on your financial situation and where you live. Here are some different options to explore.

Medicare Advantage Benefits

While original Medicare does not typically pay for home improvements, if you are enrolled in a Medicare Advantage (Part C) plan, it may offer some aid for modifications based on need. Contact your Medicare Advantage provider to see if this is available.

Medicaid Waivers

If you are low-income and eligible for Medicaid, most states have Medicaid Home and Community Based Services waivers that provide financial assistance to help seniors avoid nursing homes and remain living at home. Each state has different waivers, eligibility requirements and benefits. Contact your Medicaid office for information.

Non-Medicaid Government Assistance

Many state governments and several agencies within the federal government have programs that help low to moderate income seniors who aren’t eligible for Medicaid with home modifications. For example, the Department of Housing and Urban Development offers HUD Home Improvement Loans by private lenders. Contact a HUD approved counseling agency (call 800-569-4287) to learn more.

The U.S. Department of Agriculture has a Rural Development program that provides grants and loans to rural homeowners wanting age-in-place upgrades. Your local USDA service center can give you more for information.

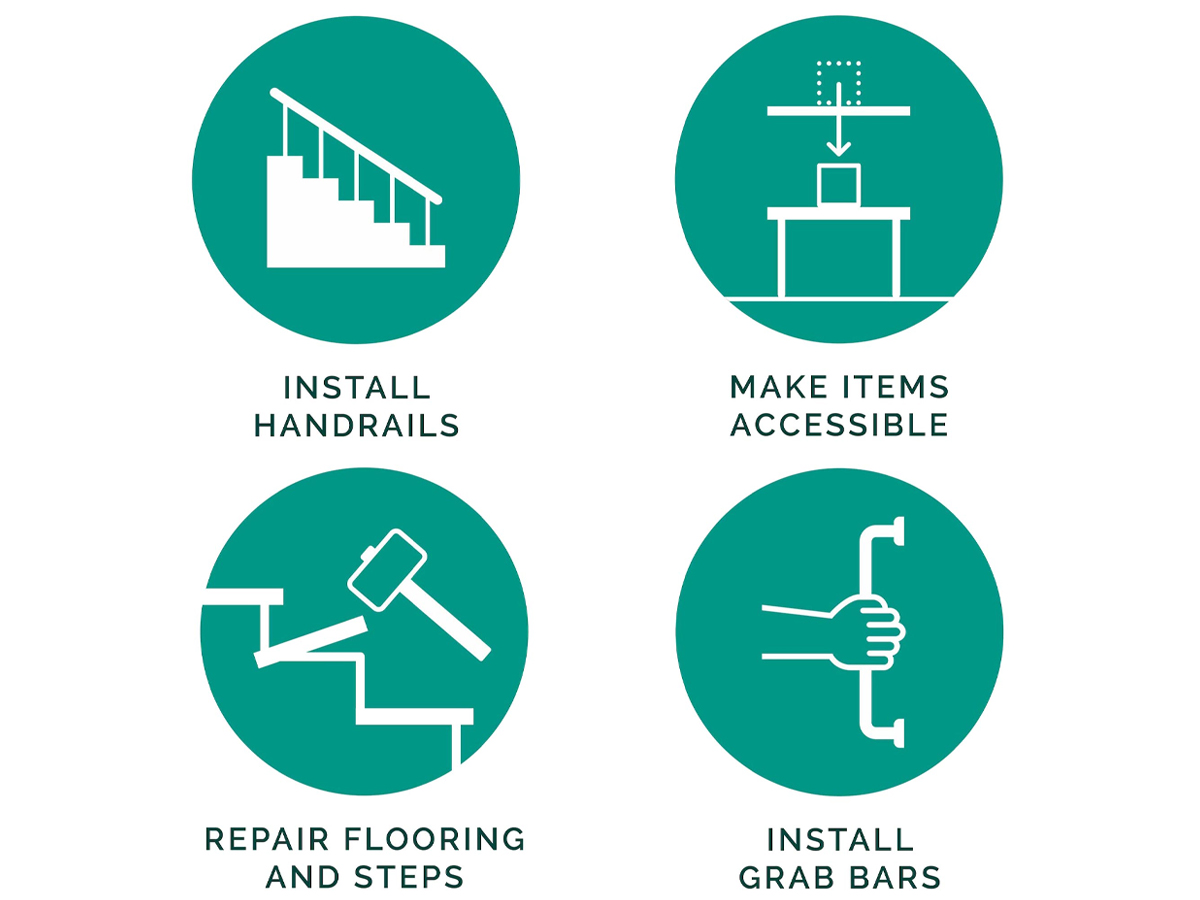

Many states also have financial assistance programs known as nursing home diversion programs. These programs, which may include grants or loans or a combination, help pay for modifications that enable the elderly and disabled to remain living at home. Modifications covered typically include accessibility improvements like wheelchair ramps, handrails and grab bars.

To find out if there are programs in your area, contact the city or county housing authority (Idaho housing authorities), the local Area Aging Agency (Idaho agencies) (800-677-1116) or the state housing finance agency (Idaho agencies) – see NCSHA.org/housing-help.

Veteran Benefits

If you or your spouse is a veteran with a disability, the VA provides grants like the SAH, SHA and HISA grants that will pay for aging-in-place upgrades in the home. See Benefits. va.gov/benefits/factsheets/homeloans/sahfactsheet.pdf for details and eligibility requirements.

Some other VA programs to inquire about are the “Veteran-Directed Care” program and “Aid and Attendance or Housebound Benefits.” Both programs provide monthly financial benefits to eligible veteran, which can help pay for age-in-place upgrades. To learn more, visit VA.gov/geriatrics or call 800-827-1000.

Nonprofit Aid for Age-In-Place Upgrades

Depending on you live, you may also be able to get assistance in the form of financial aid or volunteer labor to help with modifications. One of the most noteworthy is the organization Rebuilding Together (800-473-4229), which offers three programs: Safe at Home, Heroes at Home, and National Rebuilding Day.

Another option is community building projects, which provide seniors with volunteer labor to help them make home improvements. To search for projects in your area, do a web search containing the phrase “community building project” followed by your city and state.

Reverse Mortgage

Available to seniors 62 and older who own their own home and are currently living there, a reverse mortgage will let you convert part of the equity in your home into cash – which can be used for home improvements – that doesn’t have to be paid back as long as you live there. But reverse mortgages are expensive loans, so this should be a last resort.

For more information on these and other financial assistance programs, go to PayingForSeniorCare.com and click on “Senior Care” followed by “Home Modifications.” MSN

Send your senior questions to: Savvy Senior, P.O. Box 5443, Norman, OK 73070, or visit SavvySenior.org. Jim Miller is a contributor to the NBC Today show and author of the book, The Savvy Senior.